uTrade has unveiled a comprehensive Web3 financial trading ecosystem designed to bridge the gap between traditional finance and decentralized trading. The platform integrates artificial intelligence (AI), copy trading, non-fungible tokens (NFTs), staking, and decentralized finance (DeFi) into a single framework.

The initiative seeks to equip both new and experienced investors with tools that combine institutional-grade trading strategies and community-driven wealth sharing. Unlike narrowly focused projects in the cryptocurrency sector, uTrade positions itself as a multi-layered ecosystem, combining automated trading bots, profit-sharing NFTs, a deflationary token model, and community-first mechanisms. The result is a platform aiming for transparency, sustainability, and broad accessibility.

uTrade’s Vision: Bridging Traditional Trading and Decentralized Finance

uTrade positions itself as more than just another crypto platform. In its whitepaper, the company describes its mission as creating “a gateway to the financial trading revolution.” This vision reflects an effort to merge the precision of traditional finance tools with the open, accessible ethos of decentralized systems.

Where traditional trading often relies on complex software and closed ecosystems, uTrade seeks to make advanced trading strategies available to a wider audience. At the same time, DeFi principles such as profit sharing, token burns, and treasury reinvestment are embedded into the platform’s structure, ensuring that growth is shared with the community rather than concentrated at the top.

AI Trading Bots and Advanced Automation for Everyday Investors

At the core of the uTrade ecosystem are AI-powered trading bots, designed to adapt dynamically to changing market conditions. The Futures Grid Bot, for example, runs on the Pionex exchange and executes buy and sell orders within user-defined price grids. This type of strategy is particularly effective in sideways markets, where price fluctuations create multiple opportunities for small, repeated gains.

Beyond static grid parameters, uTrade’s AI bots are designed to process a broad range of indicators and data sources. These include Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), supply-demand imbalances, macroeconomic trends, and institutional activity. The goal is to create bots that can respond with human-like adaptability, similar to the way hedge funds and quantitative traders approach markets.

For retail investors, this means that strategies once reserved for institutions can now be deployed without technical expertise or coding knowledge. Operating 24/7, the bots reduce the need for constant monitoring, offering a degree of automation that can support both active traders and those with limited time to engage directly with markets.

Copy Trading: Verified Experts and Accessible Trading for All

Another major feature of the platform is its copy trading system, which allows users to automatically mirror the trades of experienced professionals. Available through exchanges like MEXC and BingX, copy trading provides an accessible entry point for those who may not have the expertise or time to build their own strategies.

The platform offers different replication modes — such as Smart Ratio, Fixed Amount, and Fixed Ratio — enabling users to control risk exposure in ways that match their own trading preferences.

For users seeking a more tailored experience, uTrade also provides paid signals via Telegram, covering not just cryptocurrencies but also forex, commodities, stocks, and indices. These signals include detailed entry, exit, and stop-loss levels prepared by analysts.

Additionally, the ecosystem integrates with Expert Advisors (EAs) for MetaTrader 4 and 5. Users can connect their accounts to subscribe to automated trading robots at a monthly subscription cost, extending the reach of uTrade’s strategies beyond its own platform.

NFTs With Real Utility: Profit Sharing Through uShark NFTs

In contrast to speculative NFT projects that rely on hype-driven valuations, uTrade’s uShark NFTs are designed as profit-sharing instruments tied to real trading performance.

The financial structure is clearly defined:

· 75% of NFT sale proceeds are allocated to trading capital.

· 15% goes into the treasury to ensure platform stability.

· 10% is directed to operational expenses.

Profits generated from trading are then distributed on a quarterly basis:

· 50% of profits are shared directly with NFT holders.

· 10% is used for buybacks and burns of uTrade and uShark tokens, reducing supply.

· 20% is allocated to the team.

· 20% supports the startup treasury for future innovation.

NFTs are offered in Gold, Silver, and Bronze tiers, each corresponding to a different share of the profit pool. According to the whitepaper, if the platform were to generate $100,000 in monthly profit, Gold NFTs would yield $25 per NFT, Silver NFTs $12.50, and Bronze NFTs $6.25 (Based then all NFTs where sold).

Note: The NFTs have a max supply of Bronze 3000, Silver 1500, Gold 500

This model transforms NFTs from speculative assets into utility-based instruments that generate recurring income, aligning them more closely with financial participation than digital art.

The uTrade Token (UTT): Deflationary Supply With Built-In Utility

The uTrade Token (UTT) underpins much of the platform’s ecosystem. Built with a deflationary mechanism, the token supply is capped at 50 million. Importantly, 10% of platform profits are committed to buybacks and burns, gradually reducing circulation and applying upward pressure on value.

Distribution is structured to encourage stability:

· 45% of tokens are locked in treasury for 24 months.

· 15% are reserved for exchange liquidity.

· 10% for staking pools.

· 15% for marketing initiatives.

· The remainder is allocated across presales, whitelist allocations, team compensation, and NFT airdrops.

Holding UTT provides access to exclusive services within the ecosystem, discounts on subscriptions, and eligibility for affiliate rewards. Token holders may also benefit from airdrops, particularly if they also participate in the NFT program.

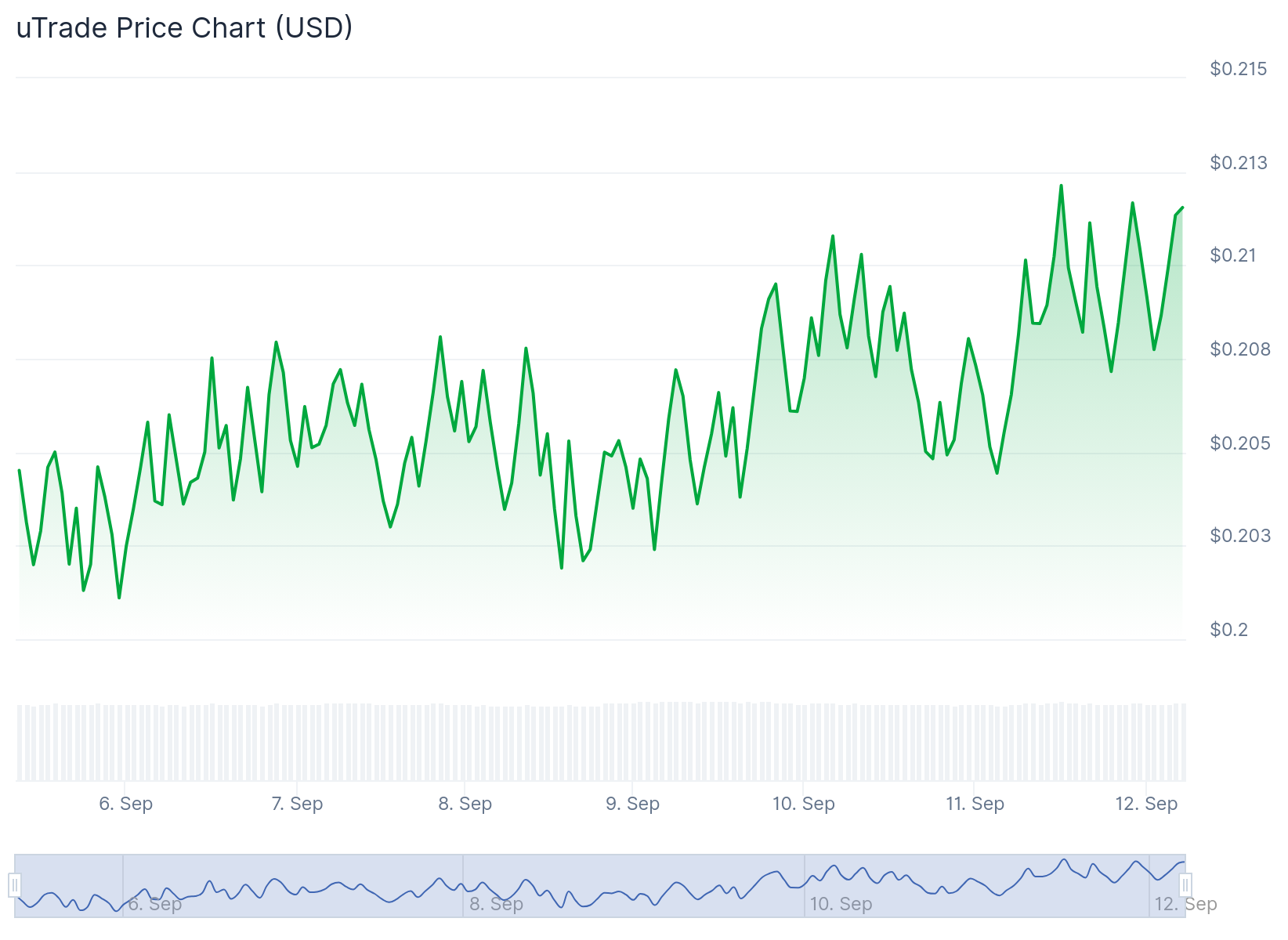

Initial pricing tiers were set at $0.05 during the whitelist phase, rising through $0.10 and $0.15 in presales, with a public launch price of $0.20.

Staking Program: Fixed APR Rewards for Long-Term Holders

To incentivize long-term participation, uTrade offers a staking program with fixed APR pools:

· 12-month lock-up: 10% APR.

· 18-month lock-up: 15% APR.

· 24-month lock-up: 20% APR.

Rewards are distributed automatically, providing predictable returns for users who commit to longer holding periods. Importantly, staked tokens do not count toward access requirements for bots or community groups — liquid UTT tokens must remain in wallets for that purpose. This design maintains both circulation and participation while rewarding those who support the platform’s stability.

Market Making Service: Self-Managed Solutions for Projects

In addition to serving individual traders, uTrade has developed a Market Maker SaaS solution aimed at crypto projects. Market making is often critical in the months following a token listing, where projects face risks from arbitrage and insider activity.

uTrade’s MM service enables projects to conduct market making in-house, rather than outsourcing to third-party providers. Bots connect via trading APIs, ensuring that project funds remain under their direct control. The platform’s built-in anti-arbitrage protections are designed to stabilize liquidity and reduce risks during vulnerable periods.

For emerging projects, this service can reduce costs, improve security, and foster greater independence.

Sustainable Growth Model and Profit Allocation

uTrade’s economic framework emphasizes sustainability and community benefit.

Ecosystem profit allocation includes:

· 50% distributed to NFT holders.

· 10% directed to token burns.

· 20% reinvested in development and uShark startup funding.

· 20% allocated to team and operations.

Revenue from sales is structured as:

· 75% to trading capital and bots.

· 15% to uShark’s treasury for long-term growth.

· 10% for operational costs such as IT and market making.

This balance reflects an effort to combine community incentives with operational resilience, ensuring that the platform can scale while maintaining trust.

Global Market Context: AI, DeFi, and NFT Growth

uTrade’s launch comes at a time when multiple financial technology sectors are expanding rapidly.

· The AI in finance market was valued at $40.7 billion in 2023 and is projected to grow to $181.8 billion by 2030, at a compound annual growth rate (CAGR) of 24.6% (MarketsandMarkets).

· The decentralized finance (DeFi) market is forecasted to reach $231 billion by 2030, with growth driven by increasing adoption of decentralized exchanges, lending protocols, and yield services (Allied Market Research).

· The NFT sector is evolving beyond art speculation toward utility-driven models, such as revenue participation and asset-backed ownership. This aligns directly with uTrade’s profit-sharing NFT design, which positions NFTs as income-generating instruments.

By operating at the intersection of these three trends — AI trading, DeFi, and utility NFTs — uTrade is entering a market with significant long-term potential.

Conclusion: Transparency, Community, and a Bridge to the Future of Wealth Creation

From its whitepaper to its website disclaimers, uTrade emphasizes that trading carries inherent risks and participants must make independent financial decisions. The company notes that market conditions can lead to losses beyond initial capital, underscoring the importance of responsible participation.

At the same time, uTrade has built mechanisms for compliance and transparency, including public Audit and KYC references, detailed profit allocation frameworks, and recurring token burn programs. By presenting itself as a community-first ecosystem, uTrade highlights its commitment to sustainability, accountability, and accessibility.

With its combination of AI-powered automation, copy trading, NFTs with real utility, and a deflationary token model, uTrade frames itself as a platform that can connect the precision of traditional finance with the openness of decentralized systems.

For more information, visit www.utrade.vip

Or join the community on X (Twitter), Telegram, Discord, and YouTube.

This announcement is for informational purposes only and not investment advice. Cryptocurrency and NFT investments involve risk; conduct independent due diligence.